Some small business owners mistakenly think that they can’t afford to offer employee benefits, but in fact they can’t afford not to. For many jobs, the value of benefits is a significant part of overall compensation, and employers are frequently not able to retain talent if the employee benefits package is not competitive. Beyond the benefits that are required by law (e.g. time off to vote, workers compensation, FICA, unemployment taxes, etc.), most employers need to offer paid and non-paid time off and other perks.

Many businesses decide to offer group health insurance, and the basic components of the plan must include a good network of local providers, and coverage for the major areas of medical care:

- Primary Care Doctors

- Specialist Doctors

- Prescription Drugs

- Emergency Coverage

- Outpatient Coverage

- Hospital Inpatient Coverage

For very small businesses, medical insurance may be enough, but for any startups with plans for growth, a group dental plan is very important to most employees. Again, it should be selected so that there’s a good selection of local in-network providers. It should include all types of dental services, generally categorized as:

- Preventative

- Minor (e.g. cavities, etc.)

- Major (e.g. bridges, crowns, etc.)

An out-of-network benefit is more important for dental benefits, since dentists are more selective about which networks they use. An experienced broker can perform a network analysis when selecting the dental plan, but the out-of-network benefit will help to cover all bases. If possible, the employer should select a dental plan that allows for immediate coverage of pre-existing conditions (although this costs extra with certain carriers). Many plans limit the amount that the carrier pays towards annual claims, and the employer must consider carefully what limits will satisfy employees.

Many small businesses neglect to have a group vision plan, but this can be one of the most cost-effective benefits for a start-up company. Not only are the plans popular, but there are inexpensive options. A lesser-known fact is that a good vision plan doubles as a great wellness benefit! An annual visit to a qualified vision provider can not only correct vision, but also can head-off some serious medical conditions, including diabetes.

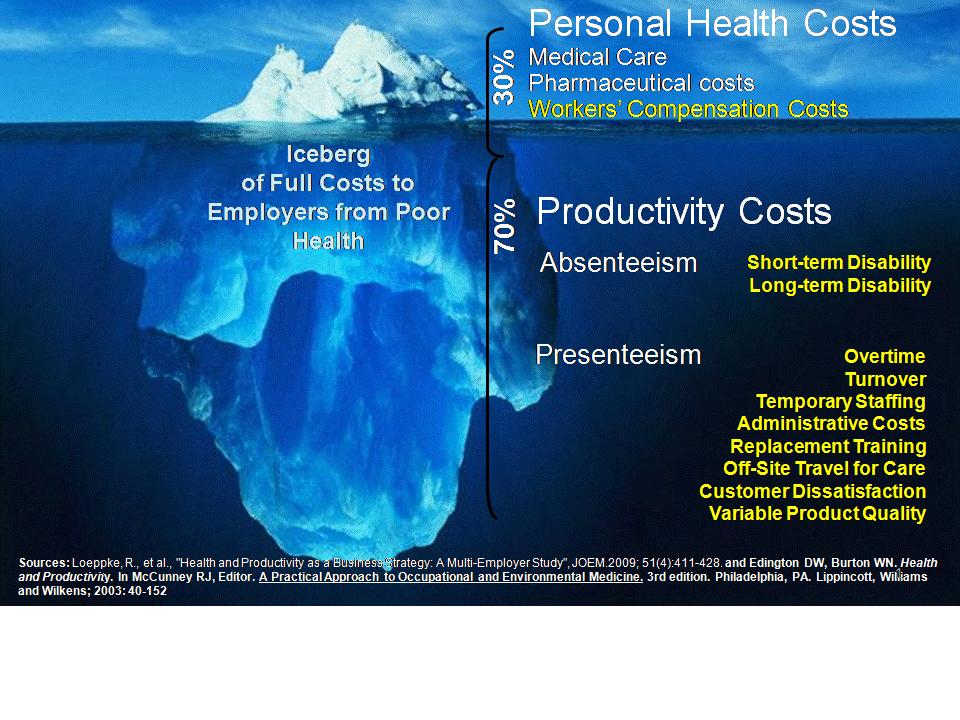

Wellness programs give businesses the opportunity to take some control of the underlying factors that are driving up their insurance costs. A wellness program may start with a “Health Risk Assessment” (HRA) whereby participants get immediate feedback on the current state of their health. Typically, the HRA will help to identify applicable Risk Factors, while also educating the participant about ways to mitigate them. Employers may use the scores (but not the private medical details) to incent employees to address their risk factors, creating a win-win for employees and employers who actively work the plan.

Simple programs, which might have incentives for employees to go to the gym or join weight-loss programs, can pay big dividends. Employees feel better and morale is improved, making the workplace more productive. Wellness programs can also help cut down on sick time and lost work days. Wellness and advocacy programs have been around for a long time, but with the trend towards “consumer-oriented” health plans, with more deductibles and out-of-pocket expenses, both NJ employers and employees have big incentives to promote and improve employee health.

Employers may offer basic benefits, and grow them over time to meet the needs of the employees. Frequently, employers will offer a core set of benefits, but offer employees the ability to “buy-up” to better coverage and/or pay towards their benefits to provide coverage to spouses and dependents. Taking the time to work with employees to provide the best overall package of benefits can go a long way to building employee satisfaction, retention and productivity, and a NJ small business benefits specialist can help with this.

For benefits proposal, contact ultimatebenefitsllc@att.net

- Why Should NJ Employers Offer Employee Benefits?

- When Should A NJ Startup Business Offer Benefits?

- What Are The Basics Of NJ Employee Benefits?

- How Should Employees Be Involved In Benefits Plan Selections?

- How Are Employee Benefits Paid For?

- How Can Employee Benefit Plans Be Used Most Effectively?

- What Types Of Rules Must Be Followed?

- What Is The Process At Policy Renewal/Plan Anniversary?

- How Can A NJ Benefits Specialist Help?

Referrals Welcomed no business too big or small